时间:2024-03-27|浏览:560

美国银行正以2020年疫情引发市场担忧高峰以来最快的速度抢购美国国债。加拿大皇家银行资本市场策略师警告称,疯狂的购买步伐可能会放缓。

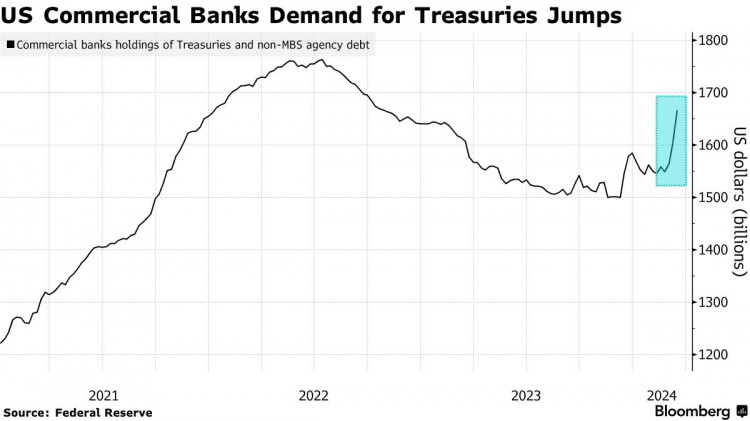

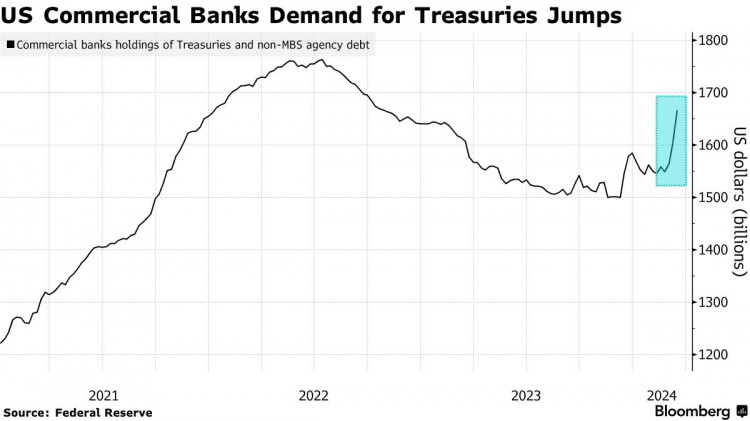

根据美联储编制的每周持有数据,截至 3 月 13 日的两周内,商业银行从联邦机构购买了 1030 亿美元的国债和非抵押债券。 分析师通常使用这一类别来衡量对美国国债的需求。 加拿大皇家银行的数据显示,这是自 2020 年 6 月以来最大的两周百分比增幅。

美国商业银行对美债的需求激增

加拿大皇家银行资本市场美国利率策略主管 Blake Gwinn 在一份报告中表示:

“由于存款余额仍然很高,贷款增长放缓,美联储降息周期迫在眉睫,银行开始在其投资组合中添加高收益国债是有意义的。”

然而,考虑到两周波动的幅度,加拿大皇家银行分析师认为,“可能还有一些更多的机械因素影响这一数据。至于具体是什么,我们并不完全确定。”

美联储主席杰罗姆·鲍威尔上周在为期两天的联邦公开市场委员会会议结束时发出的信息是,如果价格压力继续缓解,今年某个时候降息将是适当的。 Gwinn补充说,银行购买美国国债的激增并未引发市场反应,这似乎表明银行可能正在购买短期国债。 他确实预计银行对国债的需求将在中长期内普遍持续。

数据显示,美国最大的金融机构主要购买债券。 本周早些时候,道明证券策略师将近期银行需求与美联储支持放缓资产负债表缩减的言论联系起来。 达拉斯联储主席洛根一月初表示,政策制定者应开始考虑何时以及如何通过再投资更多资金来缩减 QT 计划。 美联储理事沃勒在3月1日的讲话中谈到了这个话题,表示支持增加短期国债在美联储资产中的比例。

然而,加拿大皇家银行的格温写道:“当银行确实开始增持美国国债时,更有可能是在长期持续的时间内零碎增持,而不是在两周内大规模购买。”

太平洋投资管理公司(PIMCO)正在减少其对美国国债的投资。 其首席投资官安德鲁·鲍尔斯(Andrew Balls)向英国《金融时报》表示,这家巨型债券基金持有的美国国债比平常少,更喜欢英国和加拿大等国的债券,因为他担心通胀重燃将迫使美联储降息幅度远小于以往。比最新的“点图”显示的要多。

"Outside of the U.S., we're seeing more evidence that inflation is correcting," Bowles said. "I think you can see the balance of risks from the Fed cutting interest rates more slowly than the market expects, but outside of the U.S. some central banks may move more than the market expects."

Although long-term inflation expectations in the United States are lower, inflation in the United States remains significantly higher relative to the sharp fall in inflation from the 2023 peak in the United Kingdom and Europe.

The view from the firm, which has $1.9 trillion in assets under management, is similar to consensus expectations for a Fed rate cut, but Bowles worries about the risk of "increased economic activity and sustained inflation" in the U.S., adding "you'll see to an ongoing theme of American exceptionalism.”

Expectations for interest rate cuts from the Federal Reserve, the Bank of England and the European Central Bank have fallen sharply in the past three months, with the ECB expected to cut interest rates four times in 2024, while the Bank of England and the Federal Reserve are expected to cut interest rates three times.

Finally, Barrs worries about a repeat of the surge in yields seen last fall, when markets fretted that government borrowing plans were larger than expected. "You can imagine this happening again," Powers said. "Neither Democrats nor Republicans seem concerned about the level of the fiscal deficit... If nothing exciting happens (like a UK debt crisis in 2022), the term premium is likely to slowly rise."

The chief investment officer of PIMCO said he prefers to invest in bonds that are more sensitive to interest rate changes in the United Kingdom, Australia, New Zealand and Canada. In December last year, the Financial Times reported that Pimco's chief investment officer believed that the UK was at risk of a severe economic recession and that he was betting larger than usual on British government bonds. This is not a good backdrop for the United States, which is seeing increasing bond auctions.

Article forwarded from: Golden Ten Data

用戶喜愛的交易所

已有账号登陆后会弹出下载